Bitcoin (BTC) jumped to nearly $26,000 during the asian trading hours on Tuesday, reversing Monday's decline to three-month lows under $25,000.

The move could be best described as a short squeeze – a rally powered by an unwinding of bearish derivative bets.

As prices jumped, cumulative open interest in futures and perpetual swaps trading on Binance, Bybit, OKX and Deribit fell from $5.05 billion to $4.8 billion. Open interest refers to the dollar value locked in the number of active or open positions.

The decline in open interest seemed to stem from shorts abandoning their bearish bets, as funding rates flipped positive around the same time.

Funding rates refer to costs associated with holding bullish or bearish bets in perpetual swaps (futures with no expiry). Negative rates imply leverage is skewed on the bearish side, while positive rates suggest otherwise.

"It's a textbook short squeeze," pseudonymous trader and analyst @52kskew said on X.

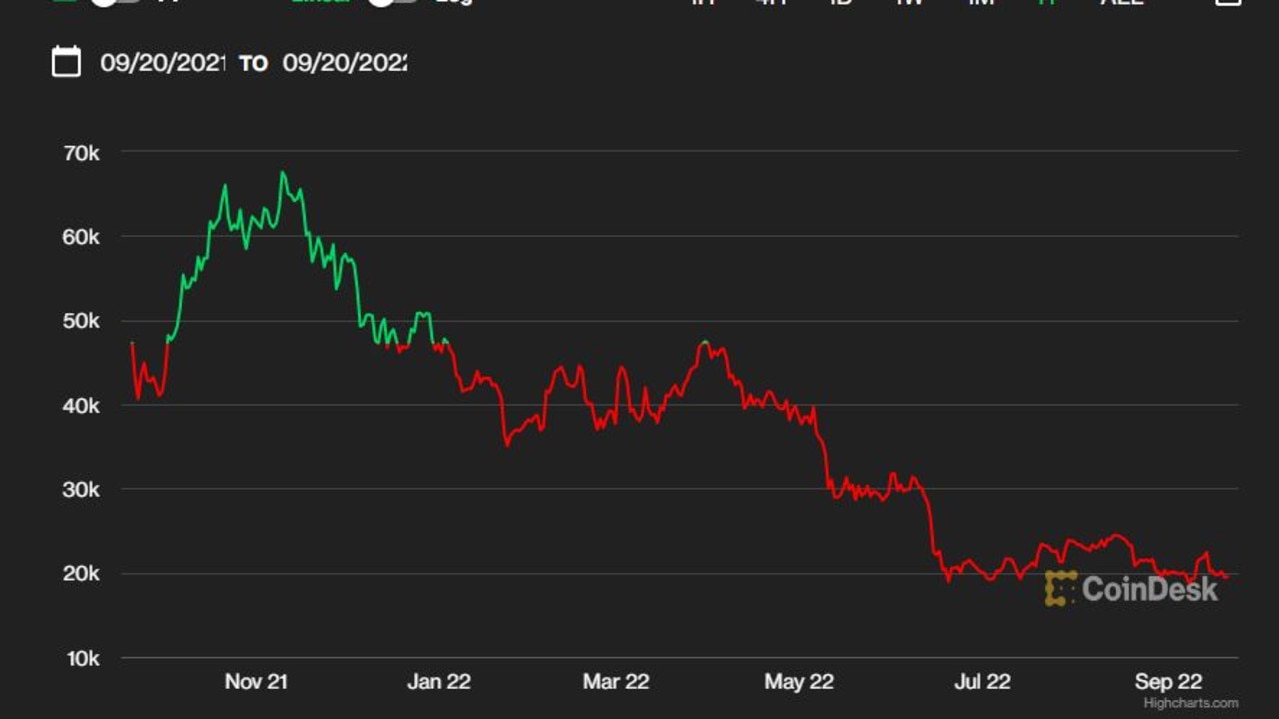

Bitcoin and alternative cryptocurrencies (altcoins) fell Monday as fears of potential selling pressure from bankrupt crypto exchange FTX roiled market sentiment.

Though impressive, the price recovery from crucial support at $25,000 may remain capped due to a lack of immediate bullish catalysts. The bitcoin spot ETF optimism has faded, with observers shifting focus to the impending liquidation of FTX's altcoin holdings.

Per some observers, the bias remains bearish while prices are held below the 50-day simple moving average.

"Bitcoin price is $25,836 below the 50-day moving average of $27,731 - which is bearish - and the week over price price decreased by 0.5%. Ethereum (ETH) price is $1,617 below the 50-day moving average $1,752 - which is bearish - and the week over price decreased by 1.1%. Overall, the trend is down, which indicates a bearish sentiment," crypto services provider Matrixport's Markus Thielen said.

Archive: Expert savages bitcoin and claims it is basically dead

Cryptocurrency exchanges review:

#1 OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2 ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3 Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4 MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5 KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6 Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7 Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog: https://sites.google.com/view/ethereum- ... al-growth/

=)